Why Your Stock Drops After Good News

Disclaimer: This post does not constitute financial advice. Do your own due diligence before making an investment.

You’re not crazy. Your stock should probably be going up. But it’s not. So what accounts for this?

In one word: Manipulation.

Wall Street is famous for this.

They also love simple explanations to explain the massive swings in stocks. They’ll say things like, “It’s a rotation to whatever you’re not invested in.”

“Bond yields are doing funky bond yield crap.”

Or my personal favorite: “It’s a sell the news event.”

Sell the news is a common trope. The implication is that the positive news was already “baked” into the stock. The news was expected imminently, and the content of the news was known to everyone.

(Yeah right.)

Do hedge funds have access to news before it’s going to drop? Definitely. People leak stuff all the time. Earnings reports, FDA decisions, failed mergers, etc. Or it could be more sinister. Bribes. Corporate theft. Sabotage.

It happens more often than you think.

Just the other day (March 8th, 2021) someone bought a ton of puts on ACADIA Pharmaceuticals, and then shortly after the company released information which the market interpreted as: The company is about to get a CRL.

CRLs (Complete Response Letters) are not good. It means the FDA has issues with your drug which need to be resolved before it’s approved.

Consequently, $ACAD dropped 48%. Whoever bought those puts made an insane amount of money. Upwards of 1500% in less than a day.

Insider trading and leaked information is a real thing.

In order for something to be a “sell the news event” that means Wall Street must have had access to this information beforehand. The stock has to have first run up, before they can run it down. This has dangerous connotations.

But selling the news doesn’t always happen, and news doesn’t always leak. Otherwise, there would have been larger moves in the stock prior to announcement. Especially if the news is bad.

What happens during a “sell the news event” is the stock keeps falling despite all the new investors buying shares. They see a great piece of news and think, “Wow this company seems great, I’d better buy some. For sure it will keep going up.”

But it doesn’t. Instead, the stock keeps inexplicably dropping.

If you see some suspicious accounts on social media parroting a narrative that it’s a “sell the news event” then you should be cautious.

What’s more likely happening is this: Wall Street is manipulating your stock because they want to own more of it.

Now that the news is confirmed, they can put this information into their discounted cash flow analysis. They can see how it will affect the price of the stock over the next 5, 10, 15 years.

Some investors are checking their stock prices multiple times per day, or even per hour. Smartphones make this easy.

When impatient investors see their stock dropping for no reason after good news, they might assume that the news wasn’t that great. They become frustrated. They see people saying it’s a “sell the news event” and so they sell. The stock didn’t do what they thought, and there are lots of other opportunities out there. (Bots and paid bashers will make you painfully aware of this.)

Investors are especially more prone to selling if they participated in the initial run-up.

Say a stock goes from $10 to $15 over three months. Then some positive news is released, and it drops to $14.50. This creates a “good enough” liquidation mentality.

Many investors would be thrilled with a return of 45% in three months. Especially since the stock market index gains (which get so much play in the news) tend to sit around 10.5% a year.

Knowing they’ve beat the market, they sell their stock during the “sell the news event” because that’s what they think others are doing.

What’s happening behind the curtain is Wall Street is buying up all they can. They’ve put the new information into their cashflow projections, and it shows the stock jumping to $30 in the next year. Or maybe two years. Or maybe even higher. Growth stocks can go parabolic very quickly, even if they’ve been flat for a decade.

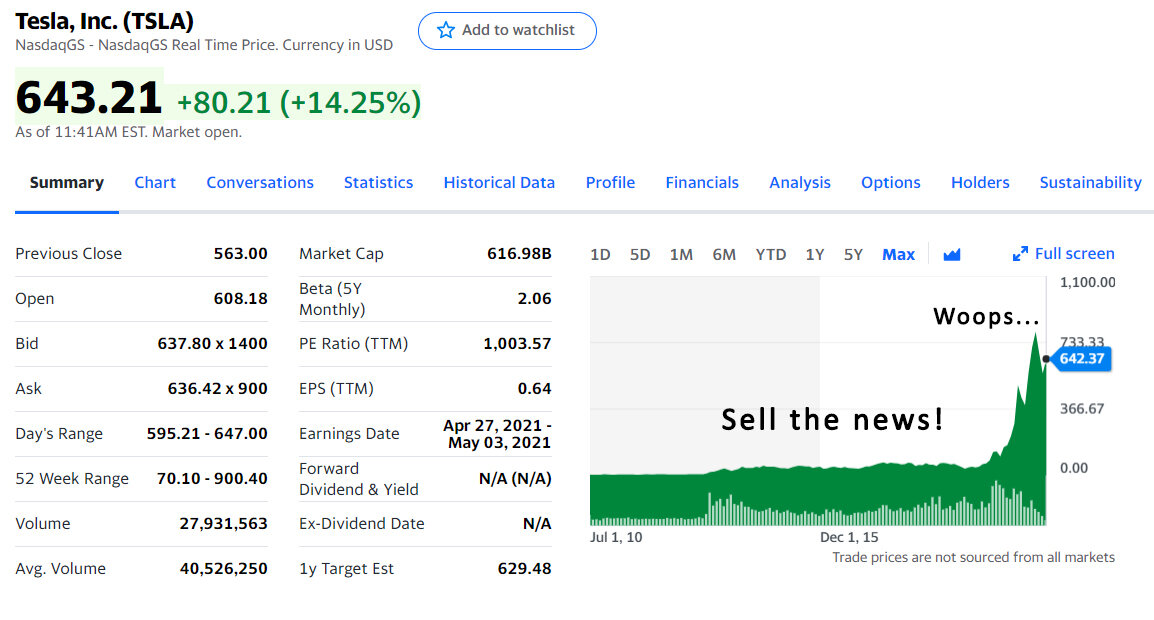

Like Tesla.

Wall Street has unlimited patience.

Most people can’t go 24 hours without checking their stocks. Even on the weekends!

Impatience is one of Wall Street’s largest attack vectors when it comes to stealing your shares.

How do we combat this?

With WIDZO.

When In Doubt, Zoom Out

People get too focused on what’s been happening lately.

They get annoyed by this:

One minute BRK-B chart on March 9th, 2021

When they should be happy about this:

So, when looking at a stock that’s selling off because the news is good, zoom out on the chart. Is the stock climbing upwards? Are the long-term prospects for this company good? Yes? Then you should probably hold.

Good companies will keep going up in value every year. Settling for a 30% gain here and there is not investing, it’s trading. Very few people get rich trading. The big money is the multibaggers.

Split adjusted, Apple was trading for $0.39 in the year 2000.

Now it’s trading at $120. That’s a gain of 307x, or 30,700%.

How many “sell the news” events do you think Apple had in the past 20 years? Probably lots. Everyone that got suckered into selling missed out on monster gains.

There’s a tendency for investors to sell their gold, and double down on their garbage. It can be tough to do the opposite, but that’s where the real money is. Although it’s a lot easier, psychologically speaking, to average down than it is to average up.

It’s human nature to want to prevent losses. They’ve done economic studies on this, and the data shows how irrational we are. It’s called loss aversion. Humans work harder to avoid losses than they do to acquire the same gain.

Let’s say you want your employee to work harder.

If you offer them a $100 bonus to hit a sales quota, they might hit it, or they might not.

But if you give that employee a $100 bonus upfront, and then tell them that $100 will be taken off their next paycheck unless they hit their sales quota, then the employee is more likely work harder to get more sales.

Loss aversion is a bizarre but effective stimulant.

It also applies to stocks when it comes time to average down.

Investors see their stock dropping on bad news and hate the idea that they might have been wrong about something. So they double down. Then they triple down. Quadruple down. Sometimes they keep buying all the way to zero.

What they should have been doing was buying more of the stock that sold off during the “sell the news” event. (And buying more of their stocks that go up!)

Because that’s what Wall Street is doing. They’re confident in their projections. Some investors are not. Those are the ones that Wall Street parasites can scare into selling when they crush stock for seemingly no reason.

Good news means higher stock prices in the long run. Pretty much almost always.

You know this. Your mother knows this. And Wall Street definitely knows this.

The only one who doesn’t know it is the tape. Wall Street will throw a lot of red at you when trying to get you to sell.

It’s unfortunate what’s happened to equities. The modern market has turned into nine months of red, and then a rocket. You almost have to totally disregard the price when making an investment decision. Short-term price action is far too manipulated to provide any quality insight.

With the rise of smartphones and social media, it has become increasingly easy for Wall Street to manipulate sentiment. All they need are bots, a few paid trolls, and they can make any company look like dogshit.

At least in the short-term.

So, when you see people saying it’s a “sell the news” event, ask yourself, “Do I believe in the long term prospects of this company?”

“Are they growing?”

“Do people or companies like and use their products?”

Yes? Then you should consider holding.

Walk away from the computer. Watching your stock drop will just frustrate you. You’ll stress out. You’ll get angry. Your heart rate will go up. You might be tempted into selling just to protect your gains, which relative to indexes are probably pretty good.

But if you hold forever, you might make more money. A lot more. Why settle for 1.45x when you could sitting on a stock that goes 307x?

Just wait. Investing is all about patience.

Eventually, Wall Street has to let the stock behave naturally. Either they’ll facilitate a buyout, take the company private, or just stop manipulating it and let it behave normally. In most cases, if you wait long enough, you’ll win.

Unfortunately, this process can take a long time. Some stocks are manipulated for years before being allowed out of Wall Street Jail.

Thanks for reading, and don’t forget to follow us on Twitter for additional in-depth analysis!