Who is Buying Massive Blocks of Gritstone Bio (GRTS) After Hours and Why?

What the heck is going on after hours with Gritstone?

Gritstone bio, a stock with only 95.34 million outstanding shares, has traded 24,497,078 shares after hours since December 22nd, 2023.

That means about 25.7% of the company has traded after hours in large blocks in the last 44 days.

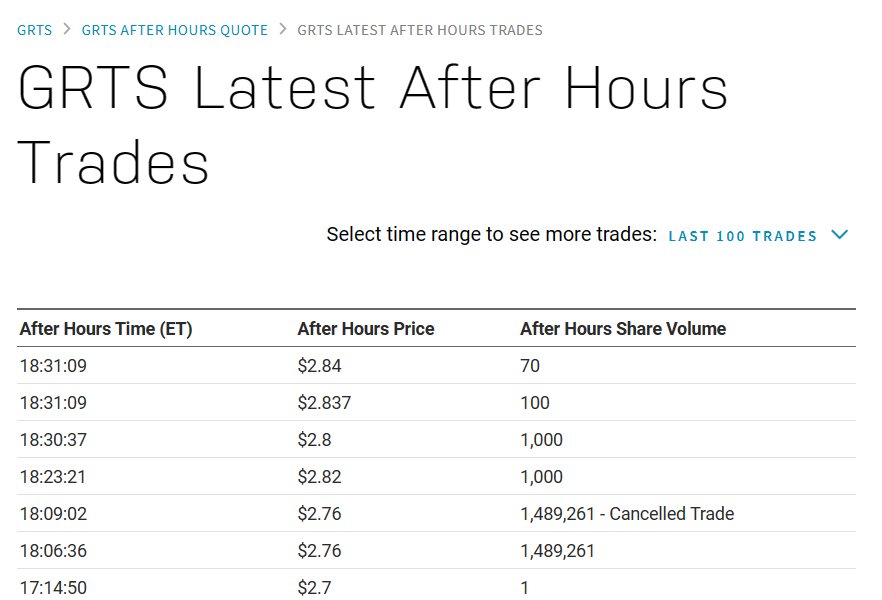

One of the transactions, a block of 1,489,261 shares was cancelled five times after hours. Most of the cancellations were processed in a few minutes. After five attempts it finally went through in the pre-market. This was an oddity, since all the other large blocks were traded after hours.

That trade was called FIVE times before going though.

Some of the blocks were huge. Like the one that traded on December 22nd. It was 5,260,000 shares. That’s 5.517% of the company. In the US, if you acquire more than 5% of a company, you need to file a 13D form within 10 days.

However, there is a form called the 13G which gets around this.

Schedule 13G is a simpler alternative to Schedule 13D and is intended for investors who acquire shares passively and do not seek to control or influence the company. The eligibility for filing a Schedule 13G instead of a Schedule 13D is primarily based on the nature of the ownership and the type of investor.

Schedule 13Gs can be filed by:

Passive Investors: These are investors who have acquired more than 5% of a class of a company's shares but do not seek or intend to change or influence the control of the company. Their investment must be purely passive, and they must not be part of any agreement, arrangement, or understanding that would lead to the acquisition, disposition, or voting of the securities in pursuit of controlling the company.

Qualified Institutional Investors (QIIs): Institutions that fall under this category, such as banks, insurance companies, investment companies registered under the Investment Company Act of 1940, and certain investment advisers, among others, may file Schedule 13G provided their investment is made in the ordinary course of business and not for the purpose of changing or influencing control of the company.

Exempt Investors: Certain investors who acquire securities through specific exempt transactions may also be eligible to file Schedule 13G.

The filing deadlines for Schedule 13G vary based on the category of the filer and the circumstances of the acquisition:

Passive Investors must file within 45 days after the end of the calendar year in which the ownership exceeds 5%, and within 10 days of the month in which the ownership exceeds 10%.

Qualified Institutional Investors generally have to file within 10 days after the month in which the ownership exceeds 10%.

Exempt Investors have specific filing deadlines depending on the context of their exemption.

Is that what’s happening here? A passive investor has been passively buying 25% of the company for passive reasons? Seems unlikely. If a company like Gilead or Pfizer were buying shares in advance of doing a massive deal with Gritstone, they would almost certainly have to file a 13D form.

Although this is America and there are always ways of manipulating the system. Intermediaries could be buying shares and keeping them in “small” accounts of less than 5%. This of course would raise significant legal and ethical issues and would probably be against the law, but again, this is America. Banks are notorious for doing shady things and then paying a small fine later.

Anyway.

Let’s get into some theories on what might be happening with Gritstone.

Theory #1: Gritstone is raising money by printing shares and dumping them

This theory gets thrown around a lot on message boards. They’ve raised money in the past at low valuations, so why not again? True, Gritstone only has enough cash left to last through 2024. They will need to raise more money at some point this year. The CEO said as much at a fireside chat on January 18th.

But he also stated that fundraising had not yet occurred, with plans to do so later in the year. Remember, the large blocks started trading December 22nd. So, unless the CEO is lying, then the 9,476,090 share that traded up until January 18th was not Gritstone raising money. They were block sales.

“Gritstone is tapping the ATM!!” seems incorrect for another reason. Upcoming catalysts. Gritstone has a bunch. They’ve got major phase 2 CRC cancer data coming by the end of March. Some think this is being timed to release near ASCO because they want it featured there.

Gritstone is also about to start a major phase2/3 novel Covid-19 vaccine study with the help of BARDA. (Who is funding it for $433M.)

With seemingly great news just around the corner, it would be dumb to sell now, unless you knew the data was bad. And if the word on the street was that you were panicking and selling shares because you knew your data was bad, then who in their right mind would be buying them?

“Hey guys, my data coming up is trash, wanna buy 25% of the company?”

“Hell yeah, brother!”

No. This does not make sense.

Even more so because past capital raises were done via private placements and communicated via press release. Like this one.

Theory #2: Institutions trading amongst themselves.

Institutions, which own about 50% of Gritstone’s outstanding shares, could be trading blocks amongst themselves. It’s been a rough few years for biotech. Some institutions might want to close large positions. Institutions have been using liquidity events the past few years to dump their positions on the market.

For example, a company releases great (but still early stage) data and the stock goes bananas. Volume rockets 500% and the stock price soars. Great for the short term trader, but institutional investors have a longer time frame. They understand excitement fades and the product is years away from the market. So, they use this opportunity to sell their shares into the frenzy. This event provides them with the liquidity they need to dump their position.

But they do this during market hours. Not after hours where liquidity is basically non-existent.

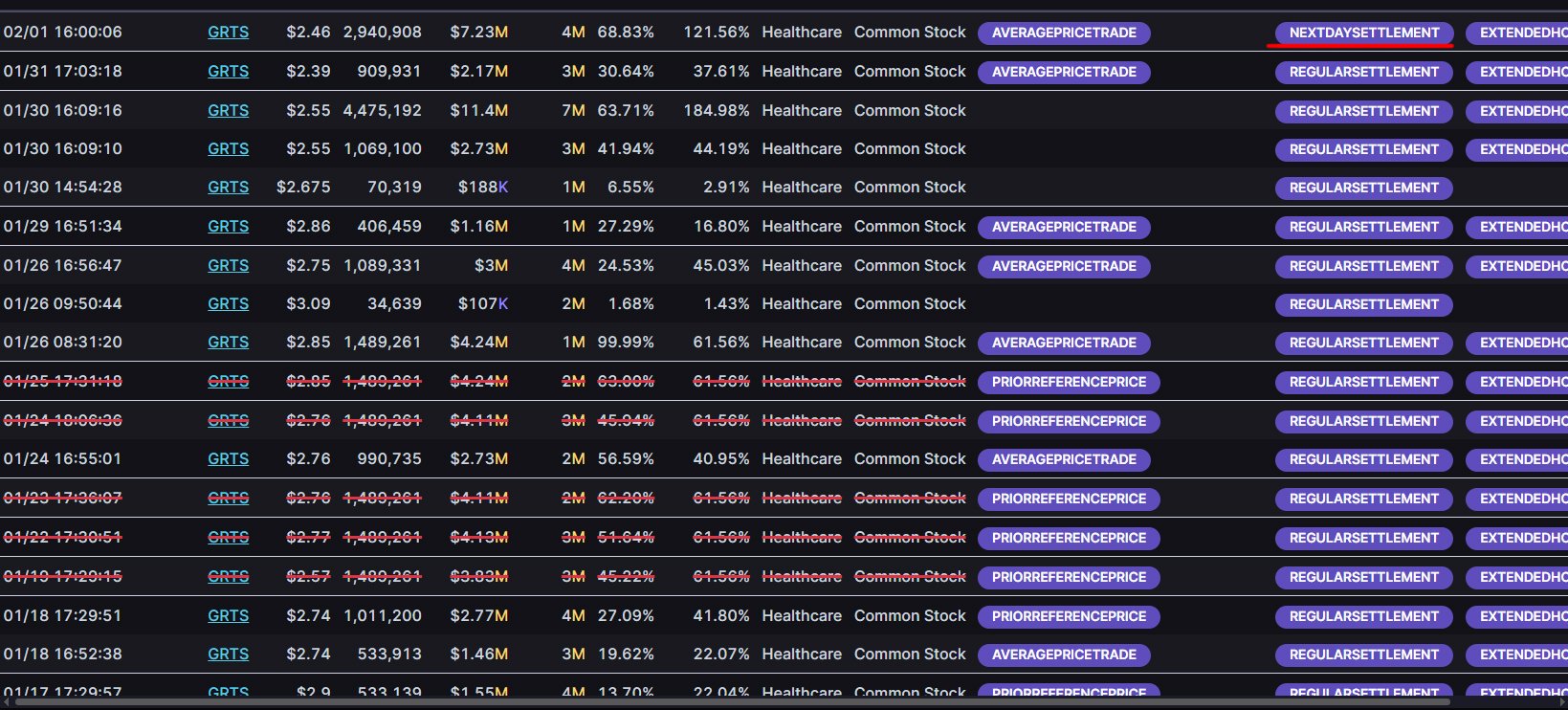

Most of the large blocks that traded after hours were bought/sold for the closing price of the day. These were obviously pre-arranged trades.

Here is a snapshot of Gritstone’s largest shareholders. (Only Blackrock has filed their latest quarterly filing, showing a small decrease, -200K in shares.) The rest, as far as we know, are still holding. Which doesn’t really make sense given how many shares have traded after hours since December 22nd.

Gritstone bio largest shareholders (from WhaleWisdom.com)

Look at the holdings. For someone to have bought 25 million shares from these holders they have had to buy out Redmile, Point72, Fraizer Life Sciences, and Vanguard.

Redmile is unlikely to have dumped, since they added last quarter. Vanguard is mostly passive index funds, and we know Blackrock didn’t sell. Maybe it was Point72 and Frazier liquidating? But that’s only about 11M shares. There’s still another 14M shares missing. The rest of the institutions don’t have enough shares to trade that many blocks.

And if the institutions did want to dump their Gritstone shares, they had the prefect opportunity at the end of September when the BARDA deal was announced. The stock went from $1.20 to $3.30 on something like 70M in volume over nine trading sessions. If they wanted out, that was the time.

Gritstone 1-day chart. (YahooFinance)

Theory #3: Gritstone is about to land a massive partnership deal.

Is someone is buying up shares in large blocks and providing the liquidity funds to exit their positions? Maybe. This would be great, but why would they sell? Imagine you’re Redmile. A mysterious intermediary approaches you and offers to buy all of your shares at the closing price.

Redmile isn’t stupid so they’ve seen the same after-hours action as we have, and would come to the conclusion that this intermediary is representing someone trying to buy up as much as the company as possible.

That is extremely bullish. Why would you sell? What’s the angle? Why hold from $10 to $1.4 only to sell out at $2.50 when something is obviously going on behind the curtain?

There are some glimmers of sense here for the acquirer. 25% is a massive stake in a company but it’s still small potatoes when you’re taking Big Pharma vs Microcap. Gilead has done deals like this before. Recently they announced they’d upped their stake in Arcus to 33%.

Gilead has an HIV vaccine candidate in pre-clinical with Gritstone. Gritstone is in line for payments up to $725M (plus royalties if they ever sell it) if the vaccine goes beyond phase 1.

I’m not saying it’s Gilead about to do a deal with Gritstone, but it could be. Gilead is reporting earnings next week and they need something exciting to talk about due to the trodelvy flop. But it could also be others. There’s plenty of cash in the coffers of Big Pharma. Someone might be about to partner with them for cancer, or their next-gen Covid-19 vaccine.

But has Gilead went around sneakily buying up large blocks after hours when making deals with other companies? I don’t think so. These deals are usually done all at once. Gilead does, however, have a history of making huge deals with companies right before data is about to drop. Like when they bought out Immunomedics for $21 billion right before they were set to release new trodelvy data.

A deal with someone else then?

A partnership would bring in a giant pile of cash. This would solve Gritstone’s financial problems and the stock price would rocket. It’s not insider trading, it’s just a smart investment. You’re buying tickets to a music festival because you know the headliner is about to be swapped with Taylor Swift.

This theory makes a good amount of sense to me, but I don’t know why these institutions are selling. It’s not like the buyer can sweeten the pot by saying, “Sell me your shares at closing price today, and when it pops later, I’ll give you more money.” That would be extremely illegal. Probably even too illegal for Wall Street to pay a fine.

Millions of shares have traded hands after hours, so I’m starting to think that at least some of them almost have to be new shares. Maybe Gritstone is printing shares but selling them all to their future partner? That would be dilution, yes, but extremely bullish dilution. It would be offset by the influx of cash from the partnership and the resulting jump in share price. Yes, you own 25% less of the company, but if they get say $100-$200M upfront, then you’re still in a better position.

The short term options market for Gritstone is also interesting

The February 16th $2.50 calls have been seeing some action lately. Premium for one contract is still $0.45 with less than two weeks until expiration. Those don’t pay out unless the stock hits $2.95. With a current share price of $2.30, this seems unlikely unless something big is about to drop.

On Friday 1,011 of these contracts traded, mostly bought at the ask. (Bullish.)

In the end, retail investors will, as always, remain in the dark and at the mercy of the news.

Thankfully this thing will play itself out sooner rather than later.

Whoever is buying these shares must file eventually. Even if the buyer has managed to sneak around the 10-day window for owning more than 5%.

Who knows, maybe we’ll see something next week?

Dark pool trades (From UnsualWhales.com)

The last block of after hours Gritstone shares sold on Thursday (February 1st) had a “next day” settlement code. All other blocks were regular settlement. Which means all the trades have now settled. Which clears up Monday morning for a major announcement. Next day settlement is used sparingly and usually for strategic purposes or risk management.

Settling quickly reduces the counterparty risk, the risk that the other party in the transaction will not fulfill their obligation.

We’ll see.

Thanks for reading, and don’t forget to follow us on X (formerly Twitter.)

EDIT: February 8th, 2024

11:30AM: Morgan Stanley just filed a 13G form showing they now own 5,519,102 shares. This is an increase of 3,756,861 shares from the previous quarter. These were purchased last quarter, so they might not even be a part of the 25M after hours block sales. Mystery continues. But this is generally a great sign. Morgan Stanley will probably pump the stock now that the cat is out of the bag.

About an hour after they filed that form, STAT News put out this article. Interesting timing.

Lots of options traded today. Someone hammered the $2.50 April calls. They bought a ton of them at the ask. Very bullish sign.

6:30PM: Another 936,000 shares traded in a block after hours. Traded for the closing price at $2.23. Regular settlement, prearranged trade.

6:45PM: Versant Venture Management just filed their 13F form. They own about 3.5M shares. Didn’t sell any last quarter. Hmmmm…

February 9th, 2024

7:30PM: Two more blocks traded after-hours today. One for 56,417 shares and one for 382,739 shares. It seems whoever is buying up these large blocks is running out of people to buy from.

I’ve been watching the options market like a hawk and I’ll post a new article this weekend. Go Chiefs.