Market Cap Spread Between Gilead and Roche Continues to Widen

Disclaimer: This post does not constitute financial advice. Author has a long position in Gilead. Do your own due diligence before making an investment.

(This is Part 5 of our Gilead/Roche merger theory. Click here for all the articles.)

There is a lot of evidence that Roche is going to merge with Gilead.

It becomes more obvious every day. Especially if you look at the widening gap between both companies’ market capitalizations.

Here is a one-month chart for Roche, December 30th, 2020.

@YahooFinance

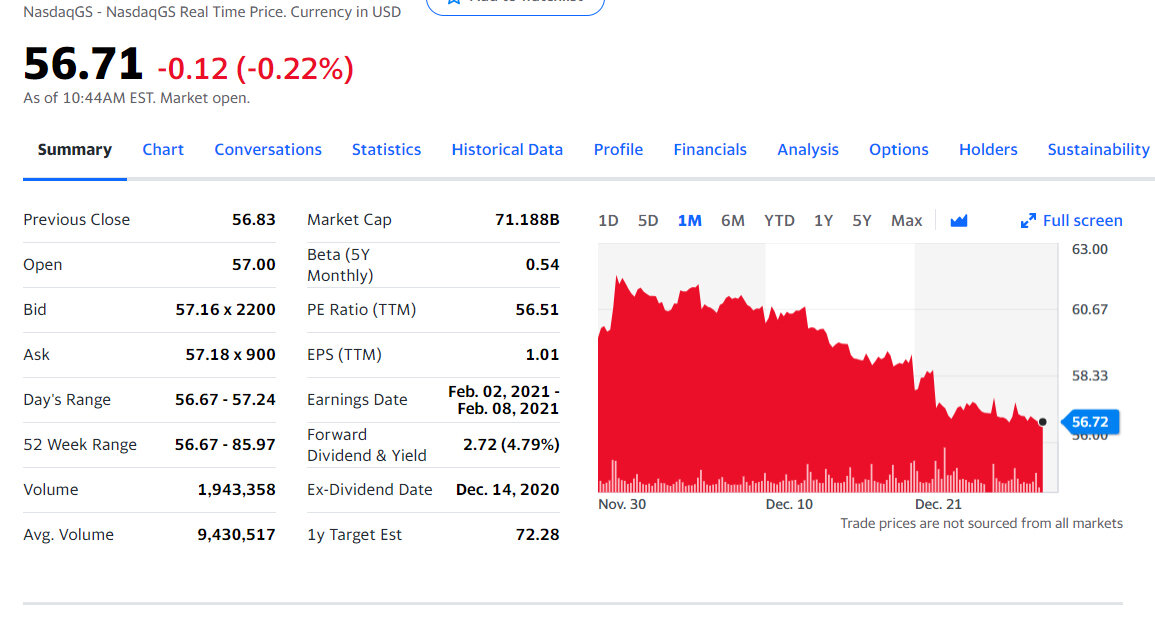

Here is a one-month chart for Gilead, December 30th, 2020

@YahooFinance (Notice the manipulators tagged another 52-week-low.)

This is exactly what both charts should look like if Roche is planning to print shares to buy Gilead.

Since 2018, Roche has added about 120B to their market cap. To buy Gilead for $90/share, they would only need about 113B.

If Roche issued shares to buy Gilead, it would set them back less than two years of gains. This would net them 20 years worth of pipeline with drugs from Gilead oncology acquisitions, like Kite and Immunomedics.

And since the intrinsic value of Gilead is close to $91.50/share, Roche has nothing to lose.

Whoever buys Gilead today gets to buyout a company for essentially zero premium, while making it look like a 50-60% premium.

The only question is: How attractive they can make the buyout offer so that institutions tender their shares?

Gilead is 80% owned by institutions, which means any buyout offer would need to satisfy several major parties. No one major shareholder can make the decision. They need 51% of the vote.

It seems like this plan has been in the works for years. Except remdesivir messed it up. Manipulators had kept Gilead’s share price pinned around $63 for most of 2019. Then COVID happened and bungled their plans. Speculators heard about remdesivir sent Gilead’s stock price to $85. This made a buyout by Roche at $90 basically impossible.

Who would sell for a buyout premium of 6%?

Nobody.

It took manipulators six months to knock the stock price back to 7-year-lows. (Which is actually more like 8 or 9-year lows, if you take into account the reduced share count from buybacks.)

The JPM healthcare conference is right around the corner. Many deals like the Celgene/Bristol Myers Squibb merger happened before this conference. In 2018, a third of all major biotech deals were announced in January.

It’s looking pretty good that someone (probably Roche) will snipe Gilead before the conference, or shortly thereafter.

The CEO of Gilead will be presenting on the opening day of the conference, January 11th.