How High Could Nvidia’s Stock Price Go? A Prediction for 2024 and 2025

Harnessing the Future: Nvidia's Reign in the Computing Power Revolution

Imagine a world where the humble abacus reigns supreme, its wooden beads sliding back and forth, dictating the pace of human progress. Fast forward a few centuries, and we find ourselves in an era where computing power, not physical prowess or even traditional resources, is the real kingmaker. This is the story of our journey from counting beads to calculating billions of operations per second, a journey where Nvidia has emerged not just as a participant, but as a reigning monarch in the computing power revolution.

The Dawn of Computing: A Humble Beginning

It all started innocently enough. The earliest computers were bulky trash cans that could barely solve simple arithmetic problems. Yet, even then, there was a glimmer of the insatiable appetite for computing power that would define our future. As these machines evolved, so too did their hunger for faster, more efficient processing capabilities. It was a slow march from the vacuum tubes and punch cards of the 1950s to the silicon chips that would eventually power the digital age.

Enter the era of personal computing in the late 20th century, a time when computers began to shrink in size but grow exponentially in importance. The demand for computing power began to outpace Moore's Law, a prediction made in the 1960s that the number of transistors on a microchip doubles about every two years, though the cost of computers is halved. This law has been the drumbeat to which the tech industry marched for decades, but as we ventured into the 21st century, it became clear that new innovations were needed to keep pace with our ambitions.

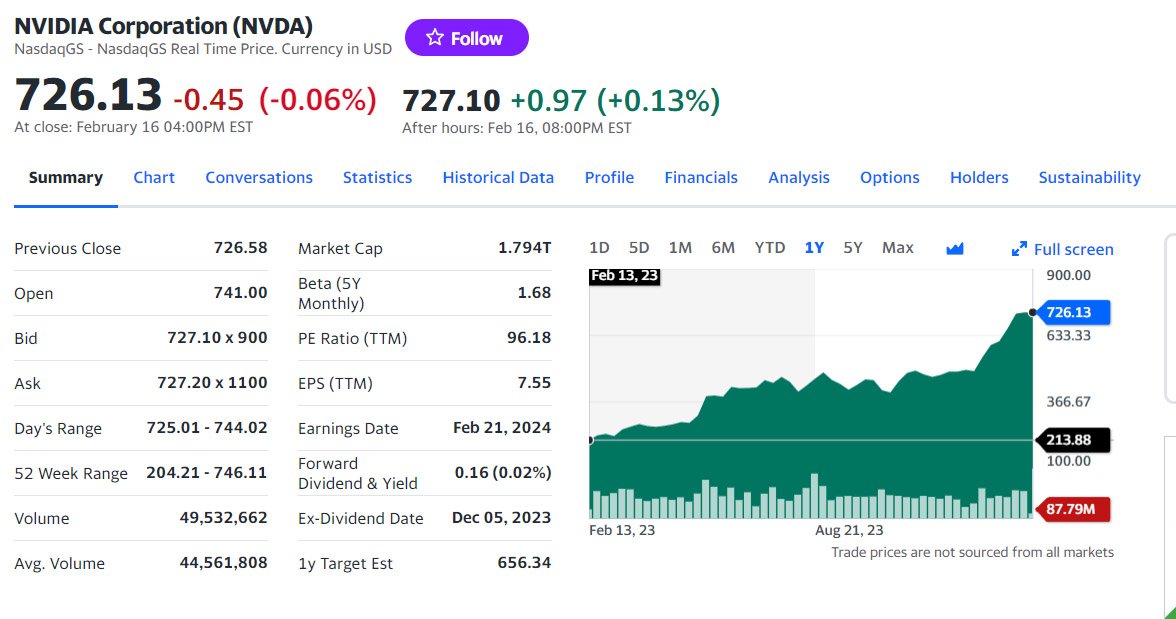

Nvidia one-year price chart. Just look at all that cheddar.

AI Drives the Demand: A New Frontier

As artificial intelligence (AI) stepped out of science fiction and into reality, the need for computing power skyrocketed. AI's voracious appetite for data and its complex algorithms required more than just incremental improvements in processing speeds; it demanded a revolution. Here, Nvidia, a company that had cut its teeth on graphics processing units (GPUs) for gaming, saw an opportunity. They pivoted, harnessing their expertise in parallel processing to fuel the burgeoning AI industry.

Nvidia: From Gaming to AI Dominance

Nvidia's GPUs, originally designed to render intricate video game graphics, proved remarkably adept at handling the matrix and vector calculations central to AI computations. This synergy propelled Nvidia to the forefront of the AI revolution, turning their GPUs into the de facto engine of AI research and development. As AI applications proliferated, from autonomous vehicles to sophisticated voice recognition systems, so too did the demand for Nvidia's chips.

The New Oil: Computing Power in the AI Era

The comparison between computing power and oil is not made lightly. Just as oil powered the industrial revolutions of the past, propelling humanity into new epochs of development and prosperity, so too does computing power stand to drive the future of human progress in the AI era. The key difference? Unlike oil, which is bound by the physical limitations of our planet, computing power is limited only by our ingenuity and ambition.

Economic and technological inflection points in history have often been marked by the discovery of new resources or the invention of new technologies. The discovery of oil fields in the 19th century transformed economies and powered new industries. Similarly, the advent of the internet and digital technologies in the late 20th century unlocked new forms of communication and commerce. Today, we stand at a similar crossroads, with AI and computing power as the driving forces.

In the tapestry of human progress, Nvidia's GPUs are not just threads but foundational weaves, supporting the ever-expanding canvas of our digital lives

The AI Renaissance

It's clear that we've entered what can only be described as the AI Renaissance—a period marked by explosive growth in artificial intelligence that rivals the burst of creativity and innovation of its 14th-century namesake. At the heart of this modern renaissance is Nvidia, a company that has donned the crown as the undisputed leader in GPU technology, driving forward the frontiers of machine learning, deep learning, and neural networks.

AI's Inflection Point

The AI landscape has been irrevocably transformed by recent advancements in machine learning, deep learning, and neural networks. These technologies have not merely progressed; they have exploded in capabilities, enabling machines to process and learn from data in ways that mimic human cognition but at a scale and speed beyond our innate capabilities. This isn't just an evolution; it's a revolution. From voice assistants that understand and respond to natural language, to autonomous vehicles navigating complex environments, the fingerprints of AI are increasingly evident in our daily lives.

This renaissance is underpinned by an insatiable demand for more computing power, to process ever-larger datasets, and to train increasingly sophisticated models. The complexity of these models, and the computational might required to bring them to life, has escalated exponentially.

Nvidia's Ascendancy

Nvidia's journey to the pinnacle of GPU technology is a saga of strategic foresight and relentless innovation. Initially carving out a niche in graphics processing for gaming, Nvidia anticipated the potential of its technology in a nascent field that would come to be known as artificial intelligence. Recognizing this potential early on, Nvidia pivoted, channeling its resources and expertise into developing GPUs that could handle parallel processing—a requirement for the complex calculations involved in AI.

This strategic shift was not without its risks. It required Nvidia to venture into uncharted territory, investing heavily in research and development, and forging partnerships with academic institutions and tech companies. These efforts were aimed at optimizing its GPUs for AI applications, a move that would eventually pay dividends.

As AI research intensified, the demand for Nvidia's GPUs surged, driven by their unparalleled ability to accelerate the training of deep learning models. Nvidia's CUDA platform, a parallel computing architecture that allows developers to harness the power of GPUs for general purpose processing, became a cornerstone of AI research, enabling breakthroughs that would have been impossible with traditional CPU-based computing.

Nvidia's technological advancements, such as the introduction of the Volta, Turing, and Ampere architectures, have continually pushed the boundaries of what's possible, setting new benchmarks for performance, efficiency, and versatility. These GPUs are not just processors; they are the engines of AI, capable of trillions of computations per second, making them indispensable for researchers, developers, and companies at the forefront of AI innovation.

The GPU Kingdom - Nvidia's Core Dominance

Welcome to the kingdom where Nvidia's dragons guard the silicon throne, forging GPUs for modern tech battles. Here, in Nvidia's GPU Empire, we embark on a journey through a realm where pixels and processing power shape the very fabric of our digital existence.

Inside the GPU Empire

Nvidia's dominion over the GPU landscape is as vast and varied as any kingdom. At the grassroots, you have the consumer graphics cards, the GeForce series, which have become synonymous with gaming excellence. These cards are not just tools for rendering the lush, expansive environments of the latest games but are the standard bearers of home computing graphics. Like the knights of the realm, they're versatile, powerful, and ever ready to take on more.

Ascending the ranks, we encounter the RTX and Data Centre GPU lines, akin to the GPU nobility. These high-end processors are designed not for gaming but for the serious business of professional visualization, data science, and AI research. They're the workhorses behind the scenes, crunching numbers, rendering complex designs, and simulating environments with a fidelity that blurs the line between virtual and reality.

And then, at the pinnacle, we have the DGX systems, the crown jewels of Nvidia's empire. These are not mere GPUs but integrated systems designed specifically for AI research, capable of handling the most complex deep learning tasks. Think of them as the GPU equivalent of the royal family, overseeing their domain with unmatched power and prestige.

Technological Innovations

Nvidia's reign is secured not just by the strength of its offerings but by its ceaseless pursuit of innovation. The kingdom's architects, the engineers and visionaries at Nvidia, have introduced several key innovations that have solidified its position at the forefront of GPU technology.

The CUDA platform stands as one of Nvidia's most significant contributions to the realm of computing. It's like the kingdom's own system of roads and highways, allowing for the efficient transport of data and instructions across the GPU's many cores. This parallel computing architecture has democratized access to high-performance computing, enabling developers and researchers to harness the power of GPUs for a vast array of applications beyond graphics rendering.

Nvidia's advancements in GPU architecture, from Pascal to Turing and beyond to Ampere, are the technological marvels that have pushed the boundaries of what's possible. Each new architecture brings with it improvements in performance, efficiency, and capabilities, like architects refining their blueprints to build ever taller, ever more splendid towers.

The Market Surge - Analyzing Demand for GPUs

Dive into the tempestuous sea of the GPU market, where the winds of demand are blowing stronger than ever before, powered by the sails of gaming, professional visualization, data centers, and the burgeoning automotive sector. The forecast? A surge in demand that's as unprecedented as it is broad, spanning the vast expanse of sectors that now rely on the unparalleled processing power of GPUs.

Forecasting Demand Across the Sectors

In the gaming realm, the hunger for more immersive, realistic experiences drives a relentless demand for more powerful GPUs. This sector, once the cradle of GPU development, continues to push the boundaries of what's possible, demanding ever-more powerful chips to render increasingly complex worlds.

But the demand for GPUs has transcended gaming, spilling over into professional visualization. Here, GPUs are the paintbrushes and chisels of our time, enabling architects, engineers, and creatives to construct and render their visions with a fidelity once thought impossible. The result? A surge in demand as industries recognize the transformative power of high-performance visualization.

The data center sector, the new frontier, has seen perhaps the most explosive growth in GPU demand. As the backbone of the AI and machine learning revolution, data centers around the world are being retrofitted with GPUs to handle the enormous computational loads required by deep learning algorithms. This shift represents a fundamental change in how data centers are built and operated, with GPUs at the core of the new architecture.

Meanwhile, the automotive industry's race towards autonomy has made GPUs indispensable. The complex task of processing the vast streams of data from sensors and cameras in real-time, making split-second decisions, requires the kind of computational might only GPUs can provide. As more manufacturers enter the fray, the demand for automotive-grade GPUs is set to skyrocket.

Comparative Demand Analysis: GPUs vs. Oil

Drawing parallels to the historical demand trends for oil, the demand for GPUs is not just a temporary spike but a fundamental shift in the resources that power our world. Just as oil fueled the industrial revolution, propelling humanity into an era of unprecedented growth and technological advancement, GPUs are fueling a digital revolution that promises to reshape the landscape of computing.

The scale of this demand is significant, mirroring the early days of oil when its potential to transform industries was first realized. Yet, unlike oil, whose demand grew in a relatively linear fashion, the demand for GPUs is accelerating at an exponential rate, fueled by the rapid advancements in technology and the ever-expanding applications of AI.

This comparison underscores not just the scale of GPU demand but its significance. Just as societies had to adapt to the realities of an oil-powered world, so too must we adapt to a future built on the computational power of GPUs. The implications of this shift are profound, touching every aspect of our lives, from the way we work and play to the fundamental structures of our economies.

The market surge in GPU demand is more than a trend; it's a testament to the critical role these processors play in powering the future. As we stand on the brink of a new era, the parallels to the oil rush of the past remind us that we are witnessing the birth of a new indispensable resource, one that promises to shape the 21st century as profoundly as oil shaped the 20th.

Financial Frontiers - Nvidia's Economic Impact

Nvidia's financial performance is a narrative of growth that reads like the plot of a blockbuster saga, where AI and GPU sales are the protagonists in a story of triumph. Year after year, Nvidia has shattered its own records, with revenue streams flowing in like torrents unleashed by the melting snows of the Silicon Mountains. This revenue revolution is no accident; it's the result of Nvidia's strategic mastery and technological prowess, which have positioned it as the heart pumping lifeblood into the AI revolution.

Driven by an insatiable market demand for GPUs, Nvidia's financials have soared to stratospheric heights. Each earnings report is a new chapter in this epic, detailing how the company's focus on AI, deep learning, and data centers has translated into revenue growth that would make even the most stoic of accountants blush. As AI weaves itself into the fabric of technology, Nvidia's coffers swell, filled with the spoils of a market hungry for the computational power only they can provide.

Stock Market Majesty: The Royal Court of Wall Street

In the royal court of Wall Street, Nvidia sits not as a mere participant but as a sovereign, commanding attention with the majesty of its stock performance. Its shares, once humble subjects in the vast empire of the market, have risen to prominence, capturing the imaginations and wallets of investors worldwide. Nvidia's stock performance is a roller coaster designed by the gods of technology and finance, climbing to dizzying heights and navigating the troughs with the agility of a cat.

Historical data paints a picture of ascendancy, with Nvidia's valuations reflecting not just the current success but the future potential of the company. The volatility, while present, is but a minor turbulence in the flight of an eagle, with investors holding on for the promise of vistas unseen. Factors influencing this majestic flight include Nvidia's relentless innovation, its strategic positioning in key growth sectors, and the broader market's appetite for technology stocks, especially those with a hand in shaping the future.

Investor confidence in Nvidia is buoyed by its consistent performance, its visionary leadership, and the ever-expanding applications of its technology. From gaming to autonomous vehicles, from data centers to the nascent fields of virtual reality, Nvidia's GPUs are the engines powering tomorrow's innovations. This confidence, however, is not blind faith; it's rooted in the tangible successes and strategic decisions that have defined Nvidia's journey.

The Global GPU Race - Competition and Collaboration

In this high-stakes contest, Nvidia's main rivals emerge with banners flying high. AMD, with its Radeon GPUs, dances a fierce tango with Nvidia, matching step for step in the consumer and professional graphics card markets. Intel, another behemoth, enters the fray with its integrated graphics and the promise of dedicated GPU lines, aiming to carve out its own dominion in this contested empire.

Yet, the battlefield is not reserved for giants alone. Emerging challengers, wielding the sharp blades of innovation and agility, make their presence known. Companies like Qualcomm and ARM offer alternatives that, while not direct competitors in traditional GPU markets, represent a shift towards versatile computing solutions across devices, challenging Nvidia's reign from the shadows.

Strategic Alliances: The Art of War and Peace

Amidst the clashing of swords, Nvidia has mastered not just the art of war but the art of peace, forging alliances that span industries and continents. Its collaborations read like a map of the tech world's powerhouses—partnerships with tech giants like Google, Microsoft, and IBM to integrate its GPUs into cloud computing platforms, bringing Nvidia's power to the masses.

But Nvidia's influence doesn't stop at the gates of tech fortresses; it extends into the realms of academia and startups, where the seeds of future revolutions are sown. Collaborations with research institutions and a nurturing hand to startups through its accelerator programs underscore Nvidia's commitment to driving innovation, not just within its walls but across the entire ecosystem.

These strategic alliances are Nvidia's bridges across the competitive chasms, allowing it to extend its influence far beyond the GPU market. They represent a network of roads on the map of the digital future, roads that are paved with Nvidia's silicon.

Investment Insights - The Bullish Case for Nvidia

Imagine you're standing at the threshold of a digital gold rush, map in hand, and X marks the spot over Nvidia's towering empire in the silicon kingdom. You're not just a spectator; you're an investor, and the treasure you seek is not gold but shares in a company that's powering the future. Welcome to the bullish case for Nvidia.

Investor's Guide: The Treasure Map to Nvidia

Embarking on this investment journey, it's important to recognize Nvidia's growth potential, akin to discovering a new continent teeming with resources. Nvidia's dominion over the GPU market, its pivotal role in AI, gaming, professional visualization, and the burgeoning field of autonomous vehicles, marks territories ripe for exploration and expansion.

Yet, every treasure map has its share of perilous waters and hidden reefs. The risks include competitive pressures, particularly from AMD and Intel, who are keen on claiming their share of the GPU bounty. Regulatory challenges and market saturation in certain segments also lurk in the shadows, potentially dampening the company's growth trajectory.

For the savvy investor, strategies to navigate these waters include a diversified portfolio approach, considering long-term growth potential over short-term gains, and staying attuned to the company's innovation cycle—key product launches and advancements can signal opportune moments to invest.

Market Sentiment: The Wind in Your Sails

Current market sentiment around Nvidia is like the trade winds for ancient mariners—knowing how to read them can make all the difference on your voyage. Analyst ratings, often the compass by which many investors navigate, remain predominantly bullish on Nvidia, buoyed by its solid financial performance and strategic positioning in growth markets.

Investor opinions, a mosaic of perspectives from the seasoned to the speculative, tend to echo this optimism, driven by Nvidia's track record of innovation and market leadership. Social media trends, the whispers and roars of the digital marketplace, amplify this sentiment, with communities rallying around Nvidia's breakthroughs in AI and gaming.

Always Sold Out

Nvidia's GPUs, particularly the H100 series, have become as sought after as the latest luxury cars, with demand that mirrors the fervor for Tesla's sleek vehicles. In this scenario, Nvidia's projected sales of around 2 million H100 units in 2024 signify a triumph in the data center and AI markets.

Given the H100's price range of approximately $30k to $40k and a gross profit margin that hovers in the realm of $21k to $28k per unit, we're not just talking about impressive revenue; we're talking about a financial juggernaut. This level of profitability, rooted in a product that's at the heart of AI and machine learning's exponential growth, sets the stage for a stock performance that could potentially mirror the ambitious ascent of its sales figures.

If we continue riding this wave of bullish sentiment, assuming the demand for Nvidia's offerings remains red-hot and the company continues to innovate at its current pace, one might speculate a continued upward trajectory for its stock price. Given the leap from $213 to $726 within a year, a continuation of this momentum could see stock prices reaching heights that reflect Nvidia's dominance in the tech sector and its critical role in powering the future of AI, gaming, and autonomous technologies.

2024 price target: $1200

2025 price target: $1800

If Nvidia maintains its course, navigating the challenges and opportunities of the tech landscape with the prowess it's shown thus far, the stock price in 2024 and 2025 could well be a reflection of its unparalleled value proposition in a world that craves computing power.

This bullish outlook hinges on a myriad of factors staying in Nvidia's favor, from market dynamics to technological advancements and the broader economic climate. As always, the realms of innovation and investment are fraught with unpredictability, making the journey as thrilling as it is uncertain.

The Quest for Nvidia

The bullish case for Nvidia is not just an investment thesis; it's a belief in a future where technology continues to transform our world, and Nvidia remains at its heart. It's a future where AI transcends science fiction, gaming reaches new heights of immersion, and autonomous vehicles become the norm. For investors, Nvidia isn't just a company; it's a conduit to participating in this future, a piece of the digital renaissance.

As you stand at the threshold, map in hand, the question isn't whether Nvidia is a treasure worth seeking—it's whether you're ready to embark on the journey.

Thanks for reading and don’t forget to follow us on X (formerly Twitter).